Peter Pan loses his ability to fly when he spends more time planning to pay for a Disney vacation than looking forward to the theme park attractions.

Disney Gift Cards

The standard “hack” for paying anything Disney is to first acquire the brand’s gift cards on the cheap. Because they can be used on not only merchandise but also theme park tickets, cruise lines, resorts, and restaurants on Disney property, these gift cards rarely go on sale. According to Reddit, it’s a unicorn appearance for Costco to carry them in bulk at a reduced price. Some gift card resale sites offer them, though at a limited discount. A common advice is to buy them at Target using a Red Card for 5% off – though I would note that it’s at most 3% better than using a 2x rewards credit card, since the Red Card doesn’t otherwise accumulate points of any kind.

Another source for buying Disney World tickets is through a third-party travel agency at a ~5% discount. Ticket types (like number of days) tend to be more limited this way than buying directly from Disney, though the 4-day ticket that we needed was an option. Since these 5% discounted tickets could be paid for using a 2x+ rewards credit card, and because I have a 5x dining card (Citi Prestige) to cover most of our non-ticket expenses, I figured that the gift card route would only be worthwhile if I could average at least an 8-10% discount.

Our timing was fortunate because lots of credit cards pumped spending bonuses in Q4 leading up to Christmas, just about time when we should be making more concrete plans. Having a large arsenal of credit cards also helped greatly. Over the course of several months, I bought nineteen Disney gift cards:

- Penfed Pathfinder (2x) had a series of $25 cash back from autumn spending promo, authorized user spending promo, and mobile wallet promo. Some of these purchases were paired with GCX.com’s second-hand discount

- Amex Business Gold (2x) had $50 Amex Offer for $200 purchase at Lowe’s

- Citi Merchant Offer (5 cards) had 10% cash back at CVS up to $250 in spend

- Chase Freedom (2x) had 5x PayPal in Q4, which was stacked with 10% discount promo of GC.com gift cards and TopCashBack rebates (which was used again when using the GC.com gift cards to buy Disney gift cards)

- Amex Offer (2x) of $25 back on $250 spend at Best Buy

- PayPal (2x) had a $10 back on $50, which was used on PayPal Digital Gifts to buy gift cards

These gift cards totaled $3,200 in face value and I had a net cost of $2,743 (14.3% off) in addition to the standard 1-2x credit card rewards.

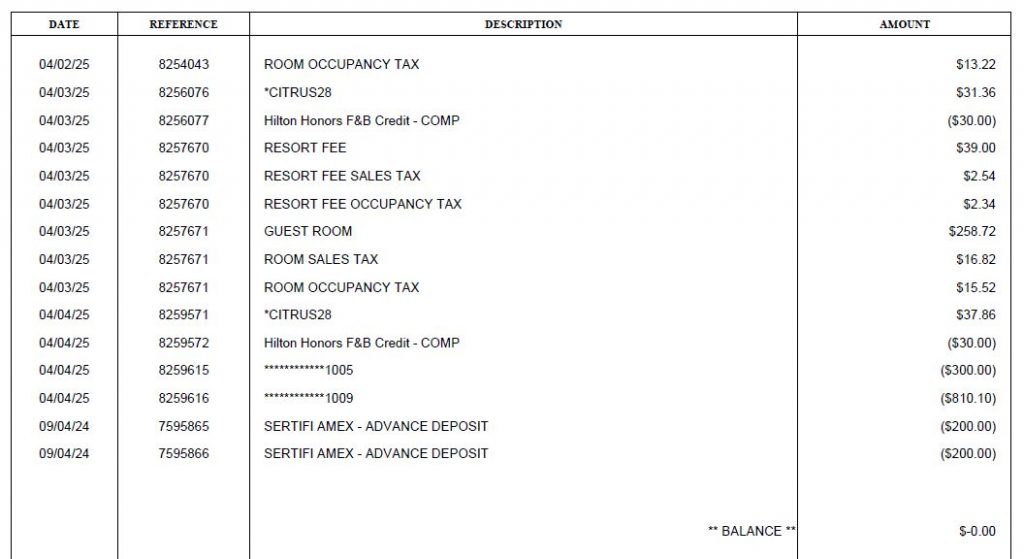

Hotel

We stayed at Hilton Orlando Buena Vista Palace. The two rooms for our families were booked under our names. Hong and I were both Hilton Diamond members (thanks to the Amex Hilton Aspire cards) and therefore entitled to some perks – we checked in early (1pm), checked out late (1pm), and had $30 in food credits per room per day. While hotel restaurants are rarely a good value, there was nowhere else to buy food when staying at a resort like this. Thus those $30 x 2 x 5 credits were pretty much cash equivalents and we enjoyed our breakfasts before starting each day.

We covered one of the rooms using points – 240,000 points for what would’ve been $1,485 in room rate, resort charge, and taxes. The points value wasn’t very appealing by default, but because we were staying five nights (5th night free on points) it worked out to 0.62 cents per point. It wasn’t fantastic, but was an above-acceptable way to reduce our cash outlay.

The second room was also booked using points until I realized that this hotel happened to be a “Hilton resort” that the Aspire card’s complicated resort credit was good for. I pre-paid $400 across two cards immediately after booking to use up the credits from the second half of 2024, and then paid the balance at check out across the same two cards to use up the credits from the first half of 2025. One of those cards also happened to give me an Amex Offer of $50 back on $250 Hilton spend, just before the trip, so that was a nice surprising bonus. In total, the five credits covered $850 of the room’s cost.

Another important feature of this hotel was its hourly shuttle to the Disney parks. I have a full post dedicated to this topic, including some rants, but it can’t be overstated just how big of a financial difference it made. We had contemplated renting a car like most people probably do when visiting Florida. However, that would require a daily parking payment of $30 at the theme parks and $37 at the hotel. Before even accounting for the cost of renting them, our two families would have dropped over $600 just to keep the cars idle for 23.5 hours per day…

Flight

I don’t know why but flying to Orlando in the spring was outrageously expensive. The most direct flights at convenient times were approaching $1,000. $807 per person only got us a mediocre option… with a connection in Seattle on the outbound, and landing around midnight in both directions.

The silver lining was, the value of a companion pass increases with the cost of the flight. We asked Bank of America nicely for two additional Alaska Airlines credit cards and rushed to meet the minimum spend on them. Afterwards, we had the privilege of “only” spending $1,904 for what would have been $3,228 in flight price.

Lounges

Not something we went out of the way to do for this trip, but the Priority Pass lounges gave us access to lounges in SFO, SEA, and MCO. The same “The Club” brand had a huge variance in quality, with SFO >> MCO > SEA. The location at MCO also made us wait a very long time that we ended up “enjoying” it for a mere ten minutes. But anyhow, the breakfast at the onset of the trip was very nice.

Disney World 2025

No Comments